5 Causes of SKU Bloat — And How They’re Killing Your Pricing Agility

Related tags

5 Causes of SKU Bloat — And How They’re Killing Your Pricing Agility

Erin Rand, Content Marketing Manager

Your SKU count is lying to you.

Your catalog may say you have 1,000 products, but in reality, you have 10 products sold in 100 slightly different ways.

This isn’t scale — it’s SKU bloat.

SKU bloat, or SKU proliferation, is the hidden tax that B2B SaaS companies pay for having a complex go-to-market: one that supports custom quotes, usage-based pricing, bundles, discounts, and more.

Each pricing variation spawns a new SKU, which may seem like a quick fix, but soon enough, you’re buried under a pile of duplicate line items, tangled billing logic, broken reporting, and quote cycles that stall out for days.

SKU bloat doesn’t just slow you down. It robs you of visibility, agility, and ultimately, revenue. And the more complex your pricing strategy gets, the more painful it becomes.

How did we get here? Let’s dig into the five biggest culprits behind SKU bloat, and what’s really at risk if you don’t get it under control.

Custom deals often lead to custom SKUs.

Sales teams love flexibility — swapping in modules, tweaking terms, and bundling features to close the deal. But under the hood, every variation demands its own SKU to satisfy billing and reporting systems. Over time, those tactical workarounds start to look like a second product catalog: one built entirely out of exceptions.

The result? The same product appears in dozens of forms across the catalog, each tied to a slightly different configuration.

Example: A company sells a "core platform" bundled with two integrations. Every new bundle or pricing arrangement becomes a new SKU to satisfy billing or reporting systems.

Tiered discounting and contract-length incentives multiply SKUs quickly. When pricing varies by subscription length, each variation requires its own SKU. Layer on different discount levels, and the SKU count grows exponentially.

Sales teams often apply discounts that fall outside standard tiers to win deals, creating even more unique SKUs. These custom discounts don’t fit neatly into predefined pricing models, forcing teams to create new SKUs manually or rely on spreadsheets to track exceptions.

Example: A single product might have SKUs for 12-month and 36-month contracts, each with 10%, 20%, and 30% discount tiers.

One product, many thresholds. Usage-based pricing creates SKU sprawl fast. To support billing, recognition, and reporting, each tier or limit often gets its own line item in the catalog.

Sales teams may want to sell a flexible, scalable product, but operational systems often demand rigidity. As customers grow or shift into new usage brackets, they’re assigned entirely new SKUs. Behind the scenes, that can mean order form revisions, revenue recognition resets, and clunky mid-cycle transitions.

The more granular your pricing model, the more SKUs you’ll need to make it work.

Example: A customer starts on a “Basic” usage tier and upgrades to “Advanced.” Instead of flipping a switch, RevOps has to swap out SKUs just to reflect the same product at a new threshold.

Upsells, renewals, and mid-term changes may keep deals moving, but they are brutal on your product catalog. Sales teams want the agility to customize mid-term upgrades, renewals, and cross-sells, but operationally, each adjustment typically requires a new SKU to reflect the pricing or configuration change.

Unlike net-new deals, these amendments aren’t clean. They’re reactive, tailored, and tied to a moment in time. But once a SKU is created, it doesn’t disappear. It lingers, cluttering your system with one-off pricing artifacts that don’t reflect your actual offering.

Do this a few dozen times a quarter, and your catalog quickly becomes bloated with redundant SKUs.

Example: A customer upgrades mid-cycle. Instead of adjusting the contract, a new SKU is created to reflect the new term. That SKU lives in the catalog forever, even though it applied to a single transaction.

Supporting both product-led and sales-led growth creates hidden duplication.

When different channels sell the same product in different ways — monthly self-serve vs. annual enterprise, for example — teams often generate separate SKUs to match each channel’s pricing, packaging, or contract terms. Internally, these decisions may feel like operational hygiene. But over time, they clutter your catalog with duplicate entries.

SKUs multiply based on how the product is sold, not what the product actually is.

Example: A customer starts on a “Basic” usage tier and upgrades to “Advanced.” Instead of flipping a switch, RevOps has to swap out SKUs just to reflect the same product at a new threshold.

Traditional CPQ and billing systems tie pricing logic directly to SKUs, but as teams experiment with usage-based models, market-specific pricing, or short-term promotions, they’re forced to create new SKUs for each variant.

What begins as a bid for more flexible pricing quickly calcifies into a complex web of catalog entries that slows down operations and breaks reporting.

This is where the real cost shows up: analytics.

SKU bloat makes it nearly impossible to isolate product performance. A single product spread across dozens of SKUs fractures the data model. Finance teams struggle to recognize revenue accurately. RevOps loses visibility into how offers are performing across regions or channels.

Even basic questions like “How is this product selling?” become a reconciliation exercise across pivot tables and disconnected systems.

The more SKUs you create, the less clarity you have. And in a world where pricing is a growth lever, not just a back-office function, that lack of clarity is a massive liability.

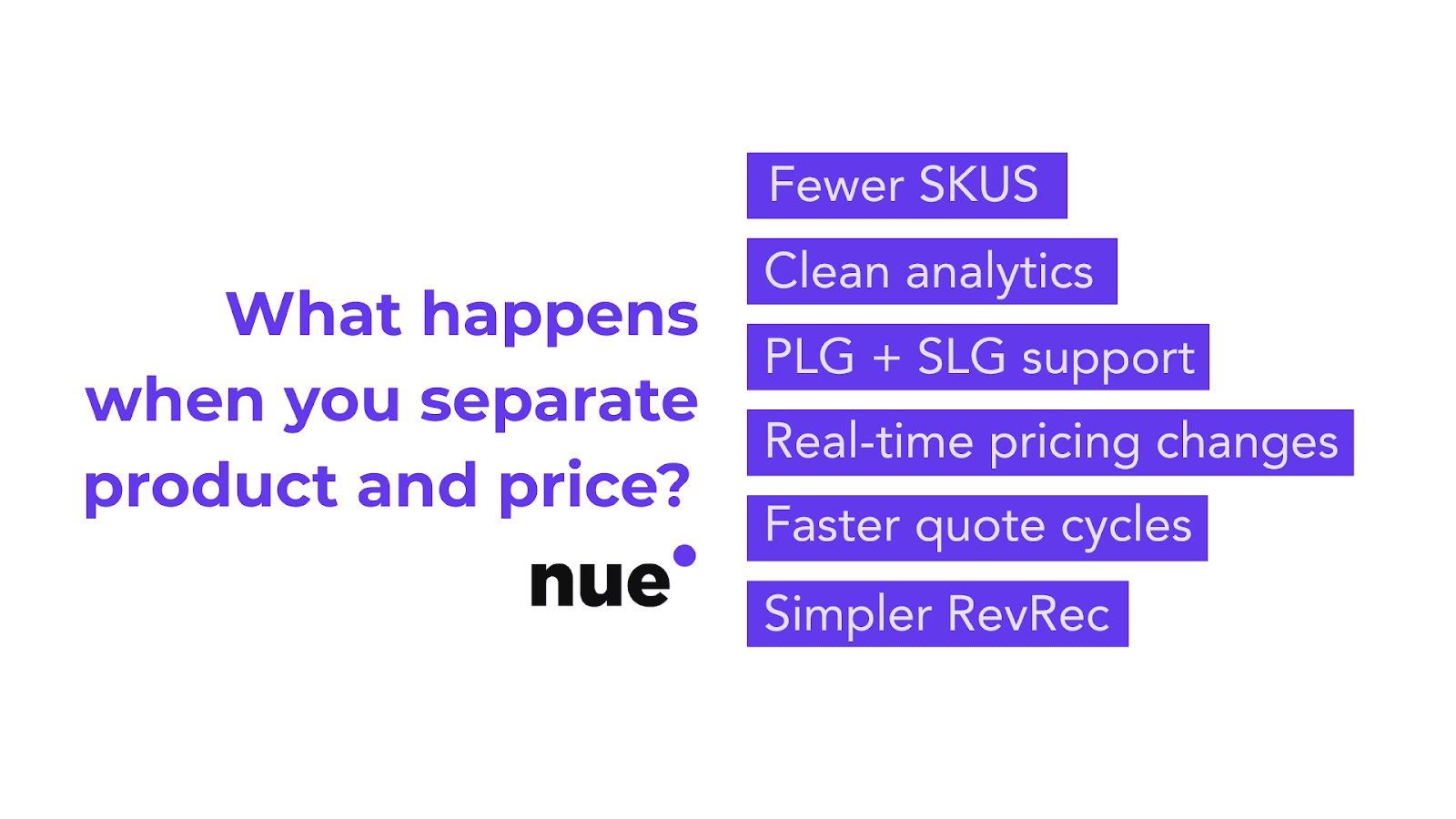

The most powerful fix for SKU bloat starts with a simple architectural shift: separate what you sell from how you sell it.

At Nue, we’ve built our platform around this principle. The product defines the thing being sold. Price defines the motion — terms, tiers, bundles, and promotions. Decoupling the two gives teams the flexibility of agile pricing without rewriting the catalog every time.

This is how you stop SKU bloat before it starts. SKUs still matter, but they no longer carry the weight of every pricing variation. Instead, you keep a clean product catalog and let pricing logic handle the complexity.

The impact ripples across the business:

- Finance gets cleaner, simpler revenue recognition

- RevOps can finally see what’s performing, where, and why

- Analytics become product-first, not SKU-first

At the center of it all is Nue’s concept of Price Tags. They’re more than a naming convention. They’re a smarter way to create dynamic pricing logic without creating operational drag.

Want to see how it works in practice? Download our new guide, which walks through five critical use cases — from ramp deals to usage pricing — and shows how Price Tags eliminate the need for rules, scripts, and duplicated SKUs. It’s a practical deep dive for any team ready to move faster without adding operational complexity.