Nue in January 2026: What to Know

Related tags

Nue in January 2026: What to Know

The Nue Team

The January 2026 release introduces new ways to automate selling, collections, and revenue operations across Nue.

These updates make it easier for sales, RevOps, and finance teams to manage products and pricing with AI, reduce manual collections work, and gain better visibility into credits and commits across their customer base.

Here’s what’s new:

- AI-powered visibility into active products, pricing, and bundles

- Automated opportunity and quote updates across Nue and Salesforce

- Automated dunning and collections for overdue invoices

- A centralized Credits page for cross-customer visibility

- Improved DocuSign e-signature workflows with enforced templates and custom fields

Let’s break it down.

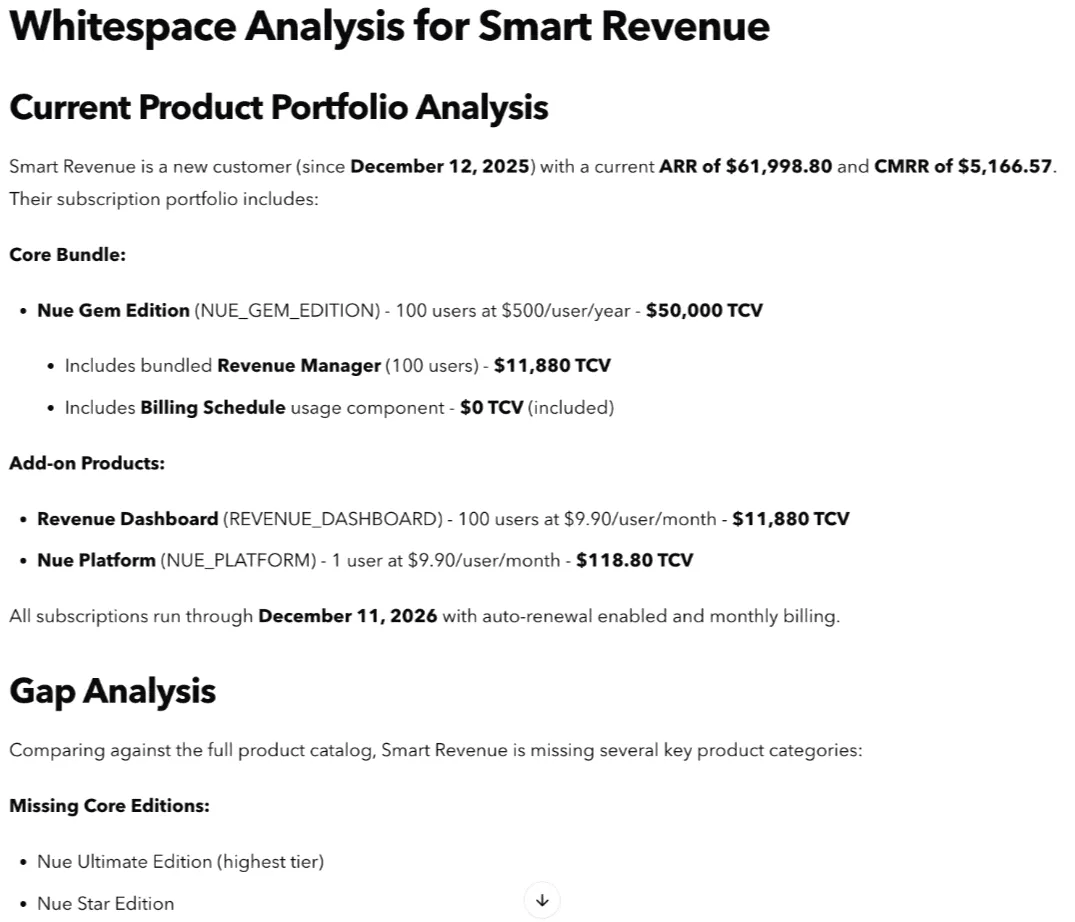

The AI Chatbot is now enriched with Product Catalog data, making it easier to understand what products and pricing are active and where gaps exist. Teams can use the chatbot to explore the current catalog in real time and run whitespace analysis to identify upsell and cross-sell opportunities.

This applies across currencies, bundles, and price tags, and works through both the Customer Chatbot and Lifecycle Manager MCP tools.

You can now:

- View all active and published products, bundles, and price tags in real time

- See current pricing across currencies and bundle configurations

- Run whitespace analysis to identify gaps in a customer’s product mix

- Publish or unpublish products and price tags for self-service channels

|

This makes it easier for sales and RevOps teams to answer practical questions like what is sellable today, what options are missing from a deal, and whether pricing is consistent across channels, without digging through catalogs or admin screens.

This release adds new Lifecycle Manager MCP tools that let teams create, query, and update Salesforce Opportunities and Quotes directly in Nue. Common actions like marking an opportunity as Closed/Won or setting a quote as the primary quote can now be handled without manual Salesforce updates.

These tools are available through the Customer Chatbot as well as other MCP-powered workflows, so teams can take action through natural language or automation while Nue enforces business rules behind the scenes.

Use Case: A sales rep closes a deal and immediately updates the opportunity to Closed/Won using the Nue chatbot. The opportunity, related products, and forecasting data in Salesforce update automatically. If a RevOps manager later needs to adjust which quote is marked as primary, they can do so in Nue, with line items and totals syncing cleanly back to the opportunity. Any validation issues surface instantly with clear error messages.

Nue now automates dunning and collections for overdue invoices using configurable, multi-stage email reminders and customer segmentation. Teams can define dunning strategies by criteria like region or risk, schedule escalating reminders, and include payment links to speed up resolution.

Dunning workflows run automatically for eligible invoices, while finance teams can monitor results and adjust strategies without manual follow-up or spreadsheet tracking.

Use Case: A global B2B finance team sets up dunning rules by region and currency. When an invoice becomes overdue, customers receive reminder emails in their local language and time zone, each with a payment link. As reminders escalate, the team tracks effectiveness in dashboards and adjusts segmentation to improve recovery rates without increasing manual workload.

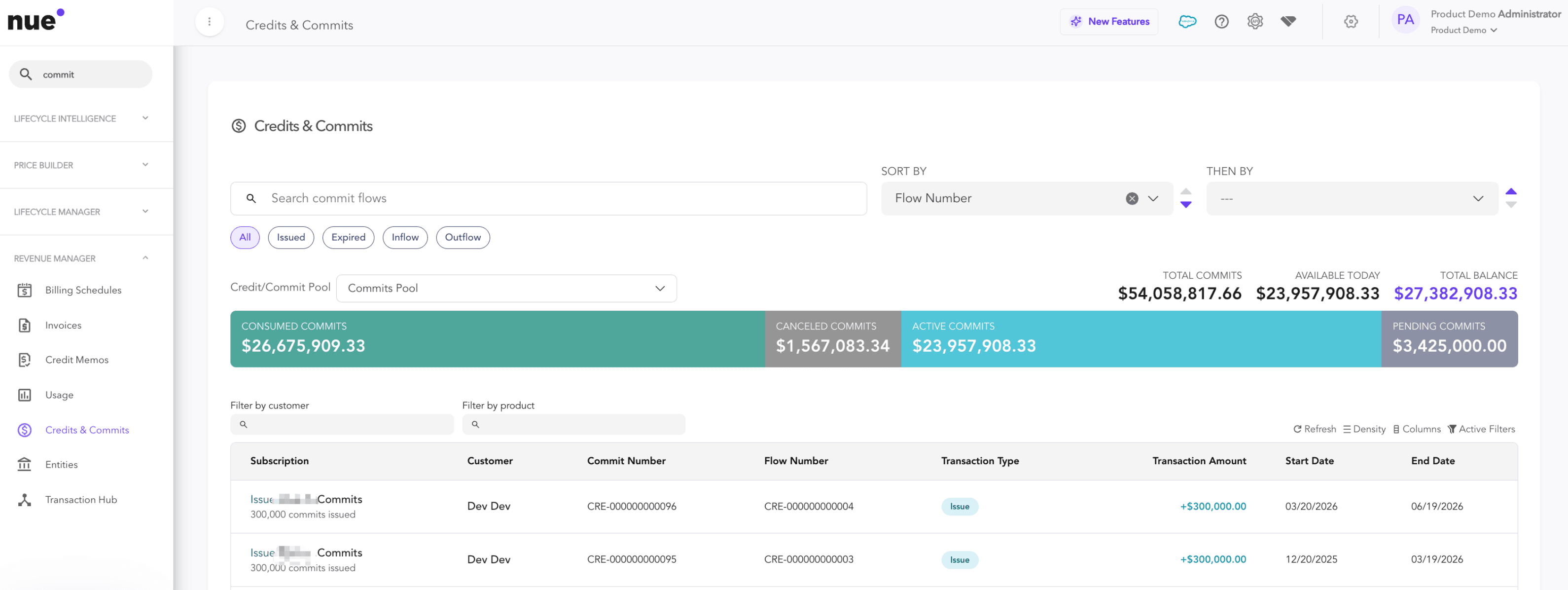

Nue now provides a centralized Credits page that lets admins view and manage credit and commit activity across their entire customer base. Instead of opening individual customer records, teams can see prepaid credit burndown, committed spend, and related billing activity in one place.

The page supports different credit pool types, including unit-based credits, cash pools, and committed cash pools, and makes it easier to understand how credits and commits are being provisioned, consumed, and billed over time.

|

Use Case: A finance director preparing for quarter-end wants to identify customers with potential underspend on committed contracts. Using the Credits page, they select the committed cash pool and quickly see active and pending balances across all customers. With a few filters, they export the data and identify which accounts are likely to trigger underspend billing, without reviewing customers one by one.

This release introduces new flexibility and automation for DocuSign-based e-signature workflows. Teams can now customize the email subject and message sent with e-signature requests, with organization-wide defaults set by admins and per-quote overrides available for sales reps when personalization is needed.

For more advanced workflows, quotes and order forms can also be sent for e-signature programmatically via API. This supports default template enforcement, recipient pre-population, customizable email content, and robust error handling, making it easier to automate high-volume or system-driven contract flows.

Together, these updates help teams standardize e-signature communications while supporting both UI-driven and API-based contract execution.

Nue now supports entity-level auto-numbering for invoices and related billing records. Teams can define custom prefixes and numbering formats for specific legal entities, ensuring invoices follow the correct format by subsidiary, region, or business unit.

Auto-numbering schemes can be managed through the UI or API, fall back to org-level defaults when needed, and enforce uniqueness so each entity uses a single, consistent sequence. This makes it easier to meet local compliance requirements and maintain continuity when migrating from legacy billing or ERP systems.

The January 2026 release closes the gap between understanding what’s happening in your revenue systems and actually doing something about it. Whether it’s spotting opportunities with AI, closing deals and syncing quotes, following up on overdue invoices, or monitoring credits and commits across customers, these updates are designed to help teams act quickly and confidently.

Instead of stitching together tools or handing work off between teams, sales, RevOps, and finance can move from insight to execution in fewer steps, with cleaner data and less manual effort.

Check out the release notes for a deeper look at each update, or book a demo to see Nue in action.